NVIDIA’s rapid and muscular growth-chart shows the chip making giant growth as promising as ever thanks to the AI bandwagon.

The company has reached $1 trillion valuation. The first of its kind to reach such a historic milestone and is making the news.

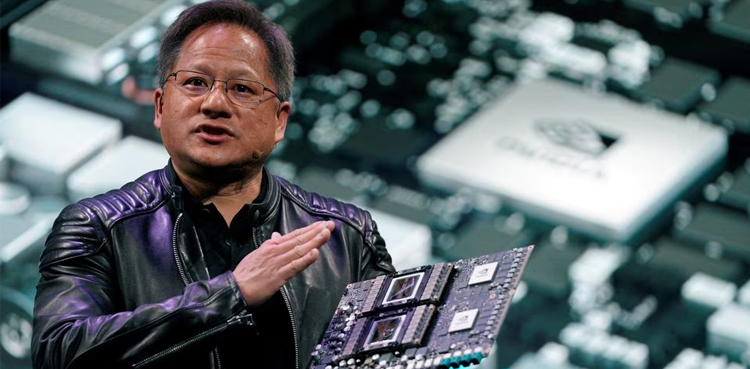

The CEO and the co-founder of the company, a Taiwanese American entrepreneur Jensen Huang proclaimed it as an “iPhone moment “for Artificial intelligence, crediting this new technology as one of the driving factors for Nvidia’s thundering growth.

For a $1 trillion market cap, the shares had to be holded on a valuation of $404.86 per share throughout the day.

On the publishing of quarterly earnings of the firm a week ago, it was witnessed that Nvidia has surpassed all of its competitors in gains except for Intel. Future sales were estimated to be at $11 billion, a figure that drastically differed from third party predictions which were just above $7 billion. The data resulted in a 25% increase in stock price, catapulting Nvidia into a $1 trillion value.

But what increased Nvidia sales to this extent?

The AI revolution, this what has been escalating the sales of Nvidia chips. This is not the first “top of the world” moments for the American Chipmaker.

Jensin Huang’s American darling has been raising demand for decades due to the rapidly growing need of GPU chips.

Initially founded in 1993 to serve the visual support requirement for video games, Nvidia successfully managed to pave its way in becoming one of the top chip manufacturers of the world.

The firm expanded its business with the internet and cloud computing boom technology. Furthermore, the global crypto mania offered it another race track to speed up on. The chips were an essential part in mining for valuable digital coins.

This was another boom for the company after the rise of cloud computing industry.

In the past 2 years, the AI frenzy took over and guess what? The large complex language processing platforms were in dire need of one thing that could assist them in running efficiently, chips, lots and lots of it.

On cashing in the AI boom, Nvidia sought to create a monopoly in the market, powering up massive AI models like Open AI’s Chat GPT and Google’s Bard with its microchip product line.

A premium state of the art quality chip from Nvidia can cost up to $40,000. And the high demand continues to surge due to the rise of investment in AI software companies.

Investors have realized a potential of artificial intelligence supported tools and aim towards funding them exorbitantly.

The capital is sufficient enough to procure these high-quality microchips that have turned out to be the lifelines of these new smart IT programs.

As this trend continues, companies like Nvidia are likely to leverage it and relish in full profits until another trend supersedes the current one.

Elon Musk, a controversial entrepreneur, has been reported to have acquired thousands of Nvidia chips for his new AI inspired ambitions. It won’t be long when we will see more organizations hopping into the bandwagon. Infact, they already have.

While Nvidia consists of the highest market share as compared to its rivals Intel, Qualcomm, TSMC, the ever-increasing requirements is resulting in the emergence of mid-level and new players.

The geo-political tensions further give space to compete for the Asian market supremacy as American and Chinese firms compete along with smaller players trying to get a piece of this cake. A dramatic 2 or 3 years have been estimated for the top winner producers to emerge, each in different regions of the globe.

from Science and Technology News - Latest science and technology news https://ift.tt/5ESLK9h

via IFTTT