ISLAMABAD: The federal government has decided to grant the status of Small and Medium Enterprises (SMEs) to the Information Technology (IT) sector and also announced tax relief for freelancers, ARY News reported on Friday.

Finance Minister Ishaq Dar unveiled the federal budget 2023-24 today with a total outlay of Rs14,460 billion.

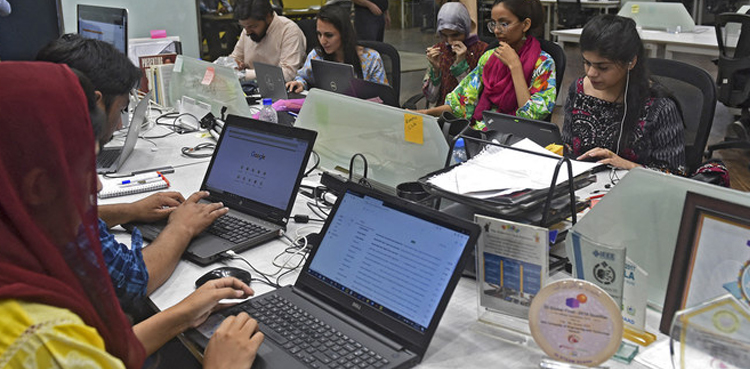

Referring to Information Technology (IT) sector, Ishaq Dar said that the incumbent government has decided to grant it the status of Small and Medium Enterprises (SMEs).

READ: Ishaq Dar unveils federal budget for FY 2023-24 with total outlay of 14.5tr

The finance minister announced that the income tax relief on IT imports has been extended till June 2026. “Furthermore, a Rs5 billion venture capital fund will be established for the IT sector,” he added.

The government has also decided to provide professional training to 50,000 IT graduates.

He said freelancers have been exempted from sales tax registration and returns for annual exports worth $24,000 in order to facilitate the business environment. In addition, a simple one-page income tax returns form is being launched for them.

READ: Budget 2023-24: Major announcements for salaries, EOBI pensions, CDNS

Under relief measures, the government made a two-year extension for the purpose of the concessionary tax rate of 20% for banking company’s income from additional advances to low-cost housing, agriculture, and SMEs including IT & ITeS.

Additionally, the government decided to encourage the export of commodities i.e. agriculture production, gems, metals and others through online platform by providing 1% concessionary final tax rate to indirect exporters.

from Science and Technology News - Latest science and technology news https://ift.tt/olMiWRn

via IFTTT